As part of the Tax Law Reform discussion series organized by the Standing Committee on Budget and the working group established under Chairman D. Amarbayasgalan's 2024 Resolution No. 292, the fourth discussion, titled "Implementation, Challenges, and Solutions of the Personal Income Tax Law," was held today (January 30, 2025) in the D. Sukhbaatar Hall of the State Palace.

The discussion was attended by MPs R. Batbold, B. Zayabal, O. Nominchimeg, along with representatives from professional associations, scholars, businesses, and taxpayers, totaling approximately 40 participants.

MP R. Batbold, a member of the working group responsible for reviewing the implementation of tax laws and preparing necessary amendments, chaired the session.

In his opening remarks, MP R. Batbold emphasized that the working group is assessing the implementation and impact of tax laws, analyzing potential shortcomings, and gathering feedback from businesses, researchers, and international organizations to ensure a fair and transparent tax environment.

Since 1990, Mongolia’s tax system has undergone multiple reforms in response to economic and social developments. The latest reform, which came into effect on January 1, 2020, introduced simplified taxation mechanisms, clearer guidelines for individuals engaged in micro-businesses, and improved deductions for taxes paid abroad. It also established clearer residency-based tax obligations and expanded tax exemptions. However, certain provisions remain challenging for taxpayers, prompting today's discussion.

B. Telmuun, director of the Tax Policy Department at the Ministry of Finance, delivered a keynote presentation on "Implementation, Current Status, and Future Measures of the Personal Income Tax Law."

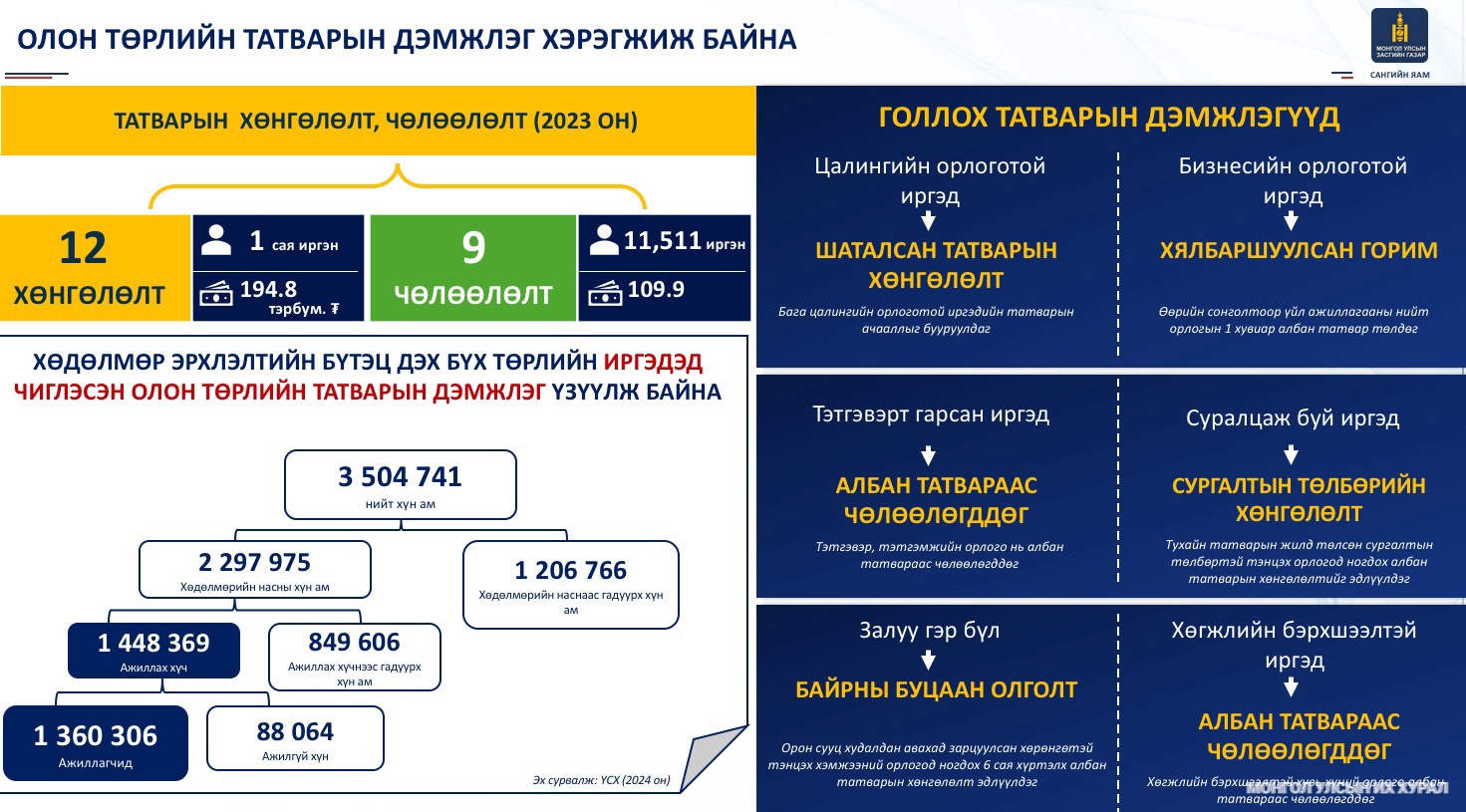

He noted that prior to 2007, Mongolia had a highly progressive tax structure before transitioning to the current 10% flat tax rate under the 4/10 taxation model. While this rate is relatively low compared to international standards, the law currently includes 12 tax deductions and 9 exemptions.

The main challenge with personal income tax (PIT) relates to how self-employed individuals report and pay taxes. The Ministry of Finance aims to transition all taxpayers to a self-declaration system, using economic incentives rather than administrative enforcement. Low-income earners currently benefit from graduated tax relief, while entrepreneurs and small business owners qualify for a simplified 1% tax regime. Pensioners and persons with disabilities are also exempt from PIT.

As of January 29, 2025, the government has received over 120,000 tax-related proposals from 36,000 individuals and 52,000 businesses, with many urging a reduction in tax rates. The Ministry of Finance is conducting a review of existing exemptions and deductions to improve their effectiveness and accessibility, while also exploring new taxable income sources and strategies to address tax evasion.

Following this, D. Saikhanchuluun, director of the Tax Administration and International Taxation Department at the General Department of Taxation, presented on "Implementation of the Personal Income Tax Law."

According to the tax authority, there are currently 2.5 million registered taxpayers in Mongolia, including 2.46 million Mongolian citizens and 41,000 foreign nationals. The number of taxpayers increased by 126.6% between 2014 and 2019, 19.2% between 2019 and 2023, and 8.6% between 2023 and 2024.

As of 2023, 5.19 million individuals benefited from PIT exemptions, totaling MNT 445.4 billion in tax-exempt income. Additionally, 1.03 million individuals received PIT deductions worth MNT 194.4 billion.

In 2023, PIT revenue accounted for 4.7% of GDP, 8.3% of total national revenue (including loans and grants), and 9.6% of total tax revenue.

During the discussion, participants raised various concerns, including whether rental income should be included in PIT calculations, the disproportionate taxation of wages versus rental income, and expanding tax exemptions for persons with severe disabilities.

In response, D. Saikhanchuluun stated that rental taxation remains a challenge, as many property owners claim they are providing housing for relatives rather than renting it for income. However, the tax authority is reviewing property ownership data to improve enforcement. He also noted that discussions are underway with the Ministry of Labor and Social Protection, the Health Insurance Fund, and the Social Insurance Authority to expand PIT exemptions for individuals with severe disabilities.

B. Telmuun from the Ministry of Finance clarified that the simplified 1% tax regime was designed to encourage self-employed individuals to participate in the e-barimt system, ensuring greater tax compliance.

Some participants suggested that Mongolia should introduce a tax rebate system similar to VAT refunds, allowing taxpayers to receive annual incentives based on their contributions. They argued that such a system would strengthen the tax base while promoting voluntary compliance.

The discussion concluded with further Q&A, allowing attendees to share their concerns and recommendations regarding future PIT reforms.

Eng

Eng  Монгол

Монгол